The Indian beverage market is a vibrant and rapidly expanding sector, characterized by its immense diversity and dynamic growth. In 2025, this industry continues its robust trajectory, propelled by a burgeoning young population, increasing disposable incomes, evolving consumer preferences, and significant advancements in distribution and digital commerce. From the fizzy allure of carbonated soft drinks to the health-conscious appeal of functional beverages and the traditional richness of dairy-based drinks, understanding the market leaders is essential for grasping the pulse of this diverse industry.

This comprehensive article delves into the top 10 beverage companies that are currently shaping India’s market in 2025. We will explore their leading brands, strategic initiatives, and the factors contributing to their prominent market share, offering a deep dive into an industry that touches the lives of over a billion consumers.

The Dynamic Landscape of India’s Beverage Market in 2025

The Indian beverage market is one of the largest globally, with its non-alcoholic segment alone valued at INR 1.37 trillion in 2023, projected to reach INR 2.10 trillion by 2029 at a compound annual growth rate (CAGR) of approximately 7.06%. This growth is influenced by a confluence of demographic, economic, and lifestyle factors.

Key Market Segments

The Indian beverage market can broadly be categorized into non-alcoholic and alcoholic segments, each with its unique drivers and dominant players:

- Non-Alcoholic Beverages: This is the largest segment, encompassing:

- Carbonated Soft Drinks (CSDs): Despite a growing health-conscious segment, CSDs remain a significant market force, driven by strong brand loyalty, extensive distribution, and recovery from past slowdowns. They are expected to grow over 10% in 2025.

- Bottled Water: Continues its robust growth due to increasing awareness of water quality and the need for hydration, particularly in urban areas. Brands are also innovating with eco-friendly packaging.

- Juices & Fruit-Based Drinks: A segment propelled by the demand for healthier, natural, and functional options. Products like fortified juices and coconut water are seeing rapid adoption.

- Dairy-Based Beverages: Flavored milk, lassi, milkshakes, and butter-milk are staples, with a rising trend towards premium and plant-based alternatives.

- Energy & Functional Drinks: Gaining immense popularity among younger demographics seeking quick energy boosts and added health benefits (vitamins, minerals).

- Hot Beverages: Tea and coffee, deeply ingrained in Indian culture, are evolving with premium, ready-to-drink (RTD), and specialty variants gaining traction.

- Alcoholic Beverages: This segment, while highly regulated, is experiencing significant growth, particularly in premium and craft categories. Whisky remains dominant, but beer, spirits, and wine are also expanding their consumer base.

Dominant Trends Shaping the Market in 2025

Several overarching trends are influencing the strategies of leading beverage companies:

- Health and Wellness: A pivotal driver, pushing companies towards low-sugar, natural, organic, and functional beverages. Consumers are increasingly scrutinizing ingredient lists and opting for healthier alternatives.

- Sustainability and Eco-Friendly Packaging: Environmental consciousness is on the rise, compelling brands to invest in recycled PET (rPET) bottles, sustainable sourcing, and reducing their carbon footprint.

- Premiumization: Across both alcoholic and non-alcoholic categories, there’s a clear upward trend in demand for premium products, artisanal offerings, and imported brands.

- Innovation & Product Diversification: Companies are continuously introducing new flavors, unique product categories (e.g., plant-based milks, kombucha), and functional benefits to capture evolving tastes.

- Digitalization and E-commerce: The rapid expansion of online retail, quick commerce platforms, and direct-to-consumer (D2C) models is transforming distribution and marketing strategies, especially in urban centers like Noida and other metropolitan cities.

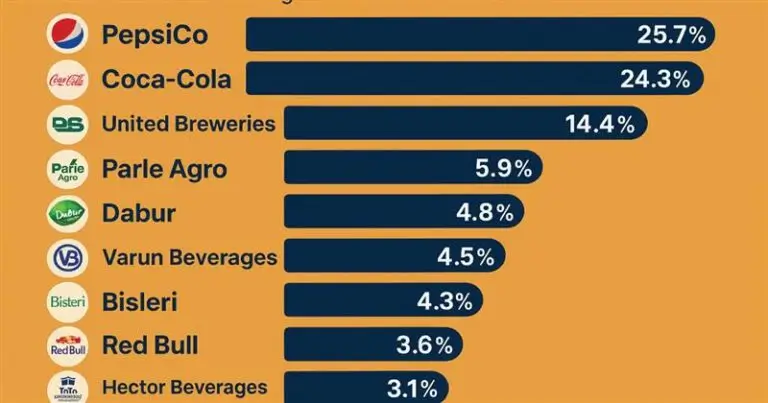

Top 10 Beverage Companies in India (2025): Leading Brands & Market Share

The following companies represent the giants of India’s beverage industry in 2025, each with a significant footprint and strategic outlook. While precise, real-time market shares fluctuate, their overall dominance and influence are undeniable.

1. Hindustan Coca-Cola Beverages Pvt. Ltd. (HCCB)

As one of the largest bottling partners of The Coca-Cola Company globally, HCCB is a formidable force in India’s non-alcoholic beverage sector. It manages the extensive manufacturing, packaging, and distribution of Coca-Cola’s diverse portfolio.

- Leading Brands: Coca-Cola, Thums Up, Sprite, Fanta, Minute Maid (juices), Maaza, Kinley (bottled water), and expanding into ready-to-drink teas and other categories.

- Market Position: Holds a dominant share in the carbonated soft drink segment and a strong presence in juices and bottled water. Coca-Cola’s global Q1 2025 results highlighted double-digit volume growth in India for Trademark Coca-Cola and Thums Up. HCCB reported a significant increase in FY24 profit to ₹2,808 crore, with revenue growing over 10% to ₹14,021.54 crore.

- Strategic Focus: Expansion into rural markets, significant investment in sustainable packaging (rPET), and product diversification to cater to health-conscious consumers.

2. Varun Beverages Ltd. (VBL)

Serving as PepsiCo’s largest bottling partner outside the US, Varun Beverages is a rapidly expanding entity with aggressive growth strategies across a vast geographical area in India.

- Leading Brands: Pepsi, Mountain Dew, 7UP, Mirinda, Slice, Tropicana (juices), Aquafina (bottled water), Sting (energy drink).

- Market Position: A key player in the CSD, bottled water, and juice segments. VBL’s robust distribution network and ambitious expansion plans (targeting 12 million outlets) underpin its continued market penetration.

- Strategic Focus: Capacity expansion (20-25% in 2025), new product introductions like ‘Sting Gold’ flavors, and collaboration with PepsiCo on new Indianized beverages, such as a Jeera-based drink, demonstrate their adaptive innovation. VBL reported strong Q4 FY25 results with impressive revenue and profit growth.

3. Dabur India Ltd.

A venerable Indian FMCG major, Dabur holds a substantial stake in the non-alcoholic beverage market, particularly recognized for its health-oriented juices and wellness drinks.

- Leading Brands: Real (juices), Real Activ (functional juices), Dabur Honey, Dabur Health Juices.

- Market Position: A top player in the packaged fruit juice category. While its beverage portfolio faced some seasonal challenges in Q1 FY26 (due to unseasonal rains impacting juice volumes), segments like “Activ Juices” and “Activ Coconut Water” continued to show mid-teen growth, showcasing resilience.

- Strategic Focus: Expanding into functional beverages with added nutritional benefits to align with the health and wellness trend. Dabur is working on strategies to reduce reliance on seasonal peaks for its beverage sales.

4. Tata Consumer Products Ltd. (TCPL)

Part of the prestigious Tata Group, TCPL is a dominant force in hot beverages and is actively expanding its footprint into other ready-to-drink and healthier beverage categories.

- Leading Brands: Tata Tea, Tetley, Tata Coffee, Tata Sampann (organic, RTD), Himalayan (bottled water).

- Market Position: Holds a strong leadership position in the packaged tea market (20% market share in FY25 for Tea). TCPL’s ‘Growth Business’ (including RTD, Tata Soulfull) grew 18% YoY in FY25, contributing significantly to revenue.

- Strategic Focus: Continuous innovation in hot beverages, aggressive diversification into healthier RTD options (e.g., Tetley Kombucha, Tata Gluco Plus Jelly, cold coffee variants), and strengthening its extensive distribution network, reaching ~4.4 million outlets.

5. Parle Agro Pvt. Ltd.

This Indian homegrown beverage giant has successfully carved a niche, challenging multinational corporations with its strong brand presence and innovative product launches.

- Leading Brands: Frooti (mango drink), Appy Fizz (sparkling apple juice), Bailley (bottled water), LMN (lemon drink), Smoodh (flavored milk).

- Market Position: A leading contender in the fruit beverage and sparkling fruit drink segments, known for its extensive reach across urban and rural India. Smoodh (launched FY22) accounts for 7-8% of overall revenues, indicating successful diversification.

- Strategic Focus: Continuous product innovation and aggressive marketing to maintain its competitive edge. Parle Agro reported an 8% YoY revenue growth to ₹1,906 crore in H1 FY25, with improving operating margins.

6. Amul (Gujarat Co-operative Milk Marketing Federation Ltd.)

While primarily a dairy cooperative, Amul is an undeniable leader in India’s dairy-based beverage market, which constitutes a significant part of the overall beverage landscape.

- Leading Brands: Amul Milk (packaged milk), Amul Kool (flavored milk – Badam, Kesar, Elaichi), Amul Kool Café (RTD coffee), Amul Tru (chocolate milk), Amul Lassi, Amul Butter Milk.

- Market Position: Commands a leading position in the organized dairy beverage market, leveraging its vast milk procurement and distribution network. Amul was recognized as India’s most valuable food brand in 2025, with a brand valuation of $4.1 billion.

- Strategic Focus: Expanding its range of traditional and modern dairy-based beverages, focusing on affordability, quality, and convenience.

7. United Spirits Ltd. (Diageo India)

As a subsidiary of global spirits behemoth Diageo, United Spirits stands as India’s largest alcoholic beverage company by volume, boasting a premium and diverse portfolio.

- Leading Brands: Johnnie Walker, Smirnoff, McDowell’s No.1, Royal Challenge, Antiquity, Black Dog.

- Market Position: Dominant in the Indian Made Foreign Liquor (IMFL) segment, especially whisky. The company’s Q4 FY25 (ending March 2025) reported net sales value (NSV) at INR 3,031 crore (+8.9%), with Prestige & Above segment growing 13.2%, reflecting strong premiumization trends.

- Strategic Focus: Continued emphasis on premiumization, innovation in product offerings, and promoting responsible consumption across its extensive brand portfolio.

8. United Breweries Ltd. (UB Group)

Controlled by Heineken, United Breweries is India’s largest beer manufacturer, holding a significant share of the country’s burgeoning beer market.

- Leading Brands: Kingfisher, Heineken, Amstel, Bira 91 (distributor).

- Market Position: Commands the largest share in the Indian beer market. Despite an EPS miss in FY25, the company reported revenue of ₹194.4 billion (up 139% from FY 2024), indicating substantial scale.

- Strategic Focus: Product innovation (e.g., low-calorie beers, craft variants), expanding distribution, and adapting to dynamic market regulations to maintain its leadership.

9. Radico Khaitan Ltd.

A prominent Indian liquor manufacturer, distiller, and marketer, Radico Khaitan has solidified its position as a key player in the IMFL segment with a strong portfolio.

- Leading Brands: Magic Moments Vodka, 8PM Whisky, Morpheus Brandy, Old Monk Rum, Rampur Indian Single Malt Whisky.

- Market Position: A significant player in the IMFL market, recognized for its strong portfolio across various price points, particularly in premium and semi-premium segments. Reported a 70.8% YoY rise in consolidated net profit in Q4 FY25, with revenue increasing by 15.16% to ₹4,485.42 crore.

- Strategic Focus: Continuing premiumization of its portfolio, expanding production capacity and distribution networks into Tier 2 and Tier 3 cities, and exploring new product categories like RTD beverages.

10. Nestlé India Ltd.

While a diversified food company, Nestlé holds a robust position in India’s beverage sector, particularly in coffee, dairy, and ready-to-drink formats.

- Leading Brands: NESCAFÉ (coffee), Everyday (dairy whitener, milk), NESTEA (iced tea), MILKYBAR (milk-based products).

- Market Position: A clear leader in the instant coffee segment and a strong contender in packaged dairy products. Nestlé India plans to invest ₹5,000 crore in capacity expansion and new product lines.

- Strategic Focus: Continuous innovation in coffee and RTD beverages, expanding its premium portfolio, and leveraging its vast distribution network, including an impressive 1.3 million additional retail outlets since 2016 and significant RUrban distribution touchpoints.

Key Factors for Sustained Success in India’s Beverage Market in 2025

The competitive and dynamic nature of the Indian beverage market necessitates a multi-faceted approach for sustained success.

Robust Distribution & Rural Penetration

Companies with extensive and efficient distribution networks, reaching beyond metros to Tier 2, 3, and rural areas, hold a significant competitive advantage. The ability to manage logistics and cold chains effectively across diverse geographies is crucial.

Continuous Innovation & Product Diversification

Adapting swiftly to evolving consumer preferences—especially the growing demand for health, wellness, and convenience—through ongoing product innovation and portfolio diversification is paramount. This includes new flavors, healthier formulations, and functional benefits.

Strategic Marketing & Branding

Effective and localized marketing campaigns, leveraging both traditional and digital media (including e-commerce and quick commerce platforms), are vital for connecting with India’s diverse consumer base. Building strong brand loyalty through consistent quality and messaging remains a core strategy.

Supply Chain Resilience & Sustainability Initiatives

Navigating potential supply chain disruptions (e.g., raw material price volatility, climate impact) and committing to sustainable practices (e.g., water stewardship, eco-friendly packaging) are critical for long-term viability and enhancing brand reputation.

Navigating Regulatory Landscape

The ability to understand and comply with India’s complex and evolving regulatory framework, particularly for alcoholic beverages and food safety, is essential for smooth operations and market access.

Challenges and Opportunities for Beverage Companies in India (2025 & Beyond)

The Indian beverage market presents both considerable hurdles and immense prospects for growth.

Challenges:

- Intense Competition: The market is crowded with strong multinational players, well-established Indian brands, and an influx of agile D2C startups, leading to fierce competition and potential price wars.

- Evolving Consumer Preferences: Rapid shifts towards healthier options, functional benefits, and sustainable choices necessitate constant adaptation and investment in R&D, sometimes at the cost of traditional offerings.

- Regulatory Complexity & Taxation: The highly fragmented and frequently changing regulatory landscape, especially for alcoholic beverages with state-specific excise duties, can pose significant operational and financial challenges.

- Infrastructure Gaps: While improving, gaps in cold chain infrastructure and logistical challenges in remote areas can impact product quality and availability.

- Environmental Scrutiny: Growing pressure to manage plastic waste, water consumption, and carbon footprint necessitates significant investments in sustainable practices and technology.

- Seasonal Volatility: As seen in Q1 FY26 with unseasonal rains impacting beverage sales, weather patterns can directly affect short-term performance.

Opportunities:

- Untapped Rural Markets: With increasing rural prosperity and digital literacy, this vast consumer base offers immense untapped potential for volume growth.

- Premiumization & Lifestyle Beverages: The rising aspirational class is driving demand for premium, craft, and experiential beverages, opening avenues for high-margin products.

- Health & Wellness Boom: The accelerated consumer shift towards health-conscious choices creates a massive opportunity for functional, natural, organic, and low-sugar beverages.

- Digital & E-commerce Channels: The explosion of e-commerce, quick commerce, and D2C models provides new, efficient, and direct ways to reach consumers, bypassing traditional distribution hurdles.

- Innovation in Packaging & Formats: Opportunities exist for innovative, sustainable packaging solutions and convenient formats (e.g., single-serve packs, multipacks) that cater to on-the-go consumption.

- Regional Flavors & Customization: Leveraging India’s diverse culinary heritage by introducing beverages with regional flavors and ingredients can create unique market propositions.

Conclusion

The Indian beverage market in 2025 is a dynamic and thriving ecosystem. The top 10 companies profiled here – from global giants like Coca-Cola and PepsiCo (via Varun Beverages) to powerful Indian conglomerates like Tata Consumer Products and local success stories like Parle Agro, alongside the dominant players in the alcoholic beverage space – are at the forefront of this growth. Their strategies revolve around a deep understanding of consumer preferences, relentless innovation, expanding distribution networks, and a growing commitment to sustainability.

As India’s economic growth continues and consumer aspirations evolve, these beverage leaders are well-positioned to quench the nation’s thirst, introducing a diverse and ever-expanding range of choices. Their adaptive business models and strategic investments will undoubtedly continue to shape the vibrant landscape of the Indian beverage industry for the foreseeable future.